Online casino

Despite its youth, Ethereum is the most popular blockchain to launch cryptocurrencies. It has become a playground for developers, swiftly expanding to become one of the most popular blockchains for decentralized apps and tokens.< https://bioenergetic-therapy.com/images/pgs/%20rules-of-entry-to-the-slot-online-casino-rocket-play.html /p>

Following a lot of hype surrounding Aptos, it slumped in its trading debut. It has faced criticism over the allocation of its tokens, with nearly half allocated to investors, core contributors and the Aptos Labs foundation. This distribution of tokens, known as tokenomics, is a prime factor when assessing a new cryptocurrency.

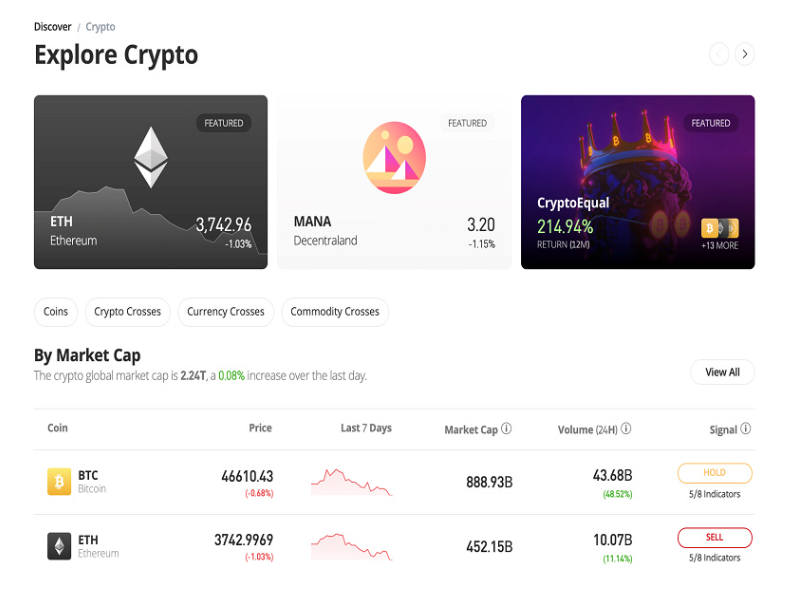

Competing metaverse Decentraland was this year’s number seven performer, after its MANA token soared nearly 40-fold. The entry of institutional players was a large contributor to gains for both SAND and MANA. This past quarter, retail giants such as Adidas and Under Armour announced partnerships with The Sandbox and Decentraland, respectively.

Best cryptocurrency

Let’s say that a company creates Stablecoin X (SCX), which is designed to trade as closely to $1 as possible at all times. The company will hold USD reserves equal to the number of SCX tokens in circulation, and will provide users the option to redeem 1 SCX token for $1. If the price of SCX is lower than $1, demand for SCX will increase because traders will buy it and redeem it for a profit. This will drive the price of SCX back towards $1.

TThe data at CoinMarketCap updates every few seconds, which means that it is possible to check in on the value of your investments and assets at any time and from anywhere in the world. We look forward to seeing you regularly!

Related Links Are you ready to learn more? Visit our glossary and crypto learning center. Are you interested in the scope of crypto assets? Investigate our list of cryptocurrency categories. Are you interested in knowing which the hottest dex pairs are currently?

Rounding out the metaverse winners is Sky Mavis’ crypto adventure game, Axie Infinity. The AXS token was 2021′s second-highest gainer, soaring 16,160%. (That’s 162 times, for those who might get lost in the five-digit percentage figure.) Axie Infinity swept through countries such as the Philippines and Venezuela as the coronavirus pandemic left many citizens in those two countries unemployed – and playing Axie to earn income. Axie’s growth fueled the emergence of more “play-to-earn” crypto projects. Some industry pundits say these crypto-powered games could accelerate crypto adoption for the masses.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

What is cryptocurrency

Systems of anonymity that most cryptocurrencies offer can also serve as a simpler means to launder money. Rather than laundering money through an intricate net of financial actors and offshore bank accounts, laundering money through altcoins can be achieved through anonymous transactions.

For Ethereum, transaction fees differ by computational complexity, bandwidth use, and storage needs, while bitcoin transaction fees differ by transaction size and whether the transaction uses SegWit. In February 2023, the median transaction fee for Ether corresponded to $2.2845, while for bitcoin it corresponded to $0.659.

In 1983, American cryptographer David Chaum conceived of a type of cryptographic electronic money called ecash. Later, in 1995, he implemented it through Digicash, an early form of cryptographic electronic payments. Digicash required user software in order to withdraw notes from a bank and designate specific encrypted keys before they could be sent to a recipient. This allowed the digital currency to be untraceable by a third party.

The first cryptocurrency was bitcoin, which was first released as open-source software in 2009. As of June 2023, there were more than 25,000 other cryptocurrencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion.

The European Commission published a digital finance strategy in September 2020. This included a draft regulation on Markets in Crypto-Assets (MiCA), which aimed to provide a comprehensive regulatory framework for digital assets in the EU.

In March 2021, South Korea implemented new legislation to strengthen their oversight of digital assets. This legislation requires all digital asset managers, providers and exchanges to be registered with the Korea Financial Intelligence Unit in order to operate in South Korea. Registering with this unit requires that all exchanges are certified by the Information Security Management System and that they ensure all customers have real name bank accounts. It also requires that the CEO and board members of the exchanges have not been convicted of any crimes and that the exchange holds sufficient levels of deposit insurance to cover losses arising from hacks.

Leave a Reply